Thinking about going green and snagging a hybrid car in 2025? You're probably wondering if you can also snag a sweet federal tax credit to help ease the financial burden. After all, every little bit counts when you're making a responsible choice for the environment (and your wallet!). Let's dive into the details.

Navigating the world of tax credits can feel like trying to decipher a foreign language. The rules and regulations are constantly changing, and it's hard to know where to turn for accurate, up-to-date information. You want to make an informed decision about purchasing a hybrid vehicle, but you don't want to get tripped up by confusing tax jargon or outdated guidelines. The frustration is real!

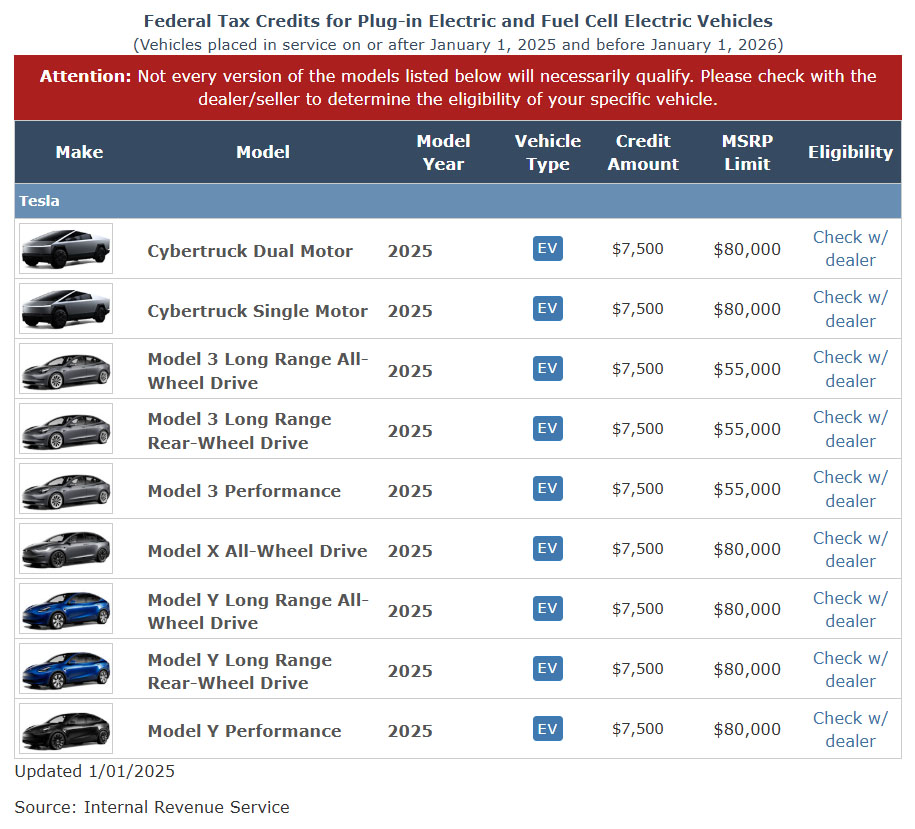

The answer to whether hybrid cars qualify for a federal tax credit in 2025 is a bit nuanced and depends on several factors. Primarily, it hinges on the specific vehicle, its battery capacity, and whether it meets the updated requirements outlined in the Inflation Reduction Act of 2022. The IRS provides a list of qualifying vehicles, so checking that list is the best way to determine eligibility. Keep in mind that the credit is not available for all hybrid vehicles and is subject to change based on evolving legislation.

In summary, the availability of federal tax credits for hybrid cars in 2025 depends on the vehicle meeting specific criteria related to battery capacity and the Inflation Reduction Act. Always consult the IRS website for the latest information and a list of qualifying vehicles. Key terms to remember are: federal tax credit, hybrid cars, Inflation Reduction Act, IRS, qualifying vehicles, battery capacity, and eligibility.

Understanding the Inflation Reduction Act and Hybrid Tax Credits

The Inflation Reduction Act (IRA) has significantly reshaped the landscape of electric vehicle (EV) and hybrid vehicle tax credits. My neighbor, Sarah, recently bought a plug-in hybrid, thinking she'd automatically get the full tax credit. She was surprised to learn that her specific model didn't fully qualify under the IRA's new sourcing and manufacturing requirements for battery components and critical minerals. It was a bit of a letdown for her, but she still received a portion of the credit, which was better than nothing. This experience highlights the importance of understanding the complexities introduced by the IRA. The IRA aims to incentivize domestic manufacturing and sourcing of EV and hybrid components, primarily batteries. To qualify for the full credit, a vehicle must meet specific requirements related to the percentage of battery components manufactured or assembled in North America and the percentage of critical minerals sourced from the U.S. or its free trade partners. The credit amount can be up to $7,500, but it's often reduced if the vehicle doesn't fully comply with these requirements. The IRA also introduced income limitations for those claiming the credit, further complicating eligibility. Therefore, buyers need to carefully research the specific vehicle they are considering and verify its compliance with the IRA's requirements on the IRS website to determine the exact credit amount they are eligible for. This includes checking the vehicle's assembly location, battery sourcing, and your own income level.

What Makes a Hybrid Qualify for the Tax Credit?

To understand if a hybrid car qualifies for a federal tax credit in 2025, it's crucial to know the defining characteristics that determine eligibility. Essentially, the vehicle needs to be a "new qualified plug-in electric drive motor vehicle" as defined by the IRS. This means it must have a certain minimum battery capacity (typically 7 kilowatt-hours or more) and be capable of being recharged from an external source of electricity. However, the definition goes beyond just technical specifications. The vehicle's manufacturer must also certify that the vehicle meets all applicable federal safety standards, and the vehicle must be acquired for use or lease, not for resale. Furthermore, as emphasized by the Inflation Reduction Act, the origin of the battery components and critical minerals plays a significant role. Vehicles with batteries sourced primarily from North America or U.S. free trade partners are more likely to qualify for the full credit. The exact amount of the credit depends on the battery capacity, with larger batteries generally qualifying for larger credits. It's also important to note that the tax credit is nonrefundable, meaning that it can only reduce your tax liability to zero; you won't receive any portion of the credit back as a refund. Keep in mind that these requirements can change, so always refer to the IRS guidelines and a qualified tax professional for the most up-to-date information before making a purchase decision. It is crucial to note that the IRS updates this list periodically. Check the IRS website for the most current list of qualified vehicles.

The Historical Context of Hybrid Tax Credits

The concept of offering tax incentives for hybrid vehicles isn't new; it's a policy that has evolved significantly over the years. The initial push for hybrid tax credits began in the early 2000s as part of broader efforts to promote fuel efficiency and reduce greenhouse gas emissions. Back then, the focus was simply on encouraging the adoption of these nascent technologies, with fewer restrictions on manufacturing location or component sourcing. Over time, as hybrid technology became more mature and widespread, the government began to refine the tax credit system. The introduction of the plug-in hybrid credit, for example, was aimed at promoting vehicles with larger batteries and greater electric driving range. However, it’s a common myth thatallhybrids automatically qualify for a tax credit. In reality, eligibility has always been subject to specific criteria and limitations. The Inflation Reduction Act marked a significant shift in policy by tying tax credits to domestic manufacturing and supply chains. This was driven by a desire to not only promote clean energy but also to create jobs and strengthen the U.S. economy. While the initial tax credits were simpler and more broadly available, the current system is more complex but also more targeted. Understanding this historical context helps to appreciate why the rules are the way they are and why it's crucial to stay informed about the latest changes. Many assume that because hybrids were incentivized in the past, they will always be. This assumption could lead to significant financial disappointment. Always verify the current eligibility of your desired vehicle.

Unveiling the Hidden Secrets of Hybrid Tax Credit Eligibility

While the IRS publishes lists of eligible vehicles and outlines the general rules for hybrid tax credits, there are some less-obvious factors that can impact your ability to claim the credit. One such "secret" is the modified adjusted gross income (MAGI) limit. Even if your vehicle qualifies, you may not be eligible for the full credit (or any credit at all) if your income exceeds certain thresholds. These income limits were introduced by the Inflation Reduction Act to ensure that the tax credits primarily benefit middle- and lower-income households. Another often-overlooked aspect is the timing of your purchase. The tax credit applies to the year in which you take possession of the vehicle, not the year in which you place the order or make a deposit. This can be significant if there's a delay in the vehicle's delivery, potentially pushing your eligibility into a different tax year with different rules. Furthermore, the tax credit is non-refundable, meaning it can only reduce your tax liability to zero. If you don't owe enough in taxes to fully utilize the credit, you won't receive the remaining amount as a refund. Finally, be aware of potential changes to the tax laws. Tax regulations are subject to revision by Congress, and it's possible that the rules for hybrid tax credits could change in the future. Keeping abreast of legislative developments and consulting with a tax professional can help you navigate these hidden complexities and maximize your potential tax benefits. Don't assume that because you qualified last year, you'll qualify again this year, or vice versa. Staying informed is key.

Recommendations for Maximizing Your Hybrid Tax Credit

If you're serious about buying a hybrid car and want to maximize your chances of receiving a federal tax credit in 2025, here are some practical recommendations. First and foremost, do your research! Don't rely solely on the salesperson's information or outdated articles. Visit the IRS website and consult the list of eligible vehicles. Double-check that the specific model you're considering meets all the requirements, including battery capacity and sourcing. Second, consider timing your purchase strategically. If you anticipate your income exceeding the MAGI limits in a future year, it might be advantageous to buy the vehicle sooner rather than later. Conversely, if you expect a significant increase in your tax liability in a future year, delaying the purchase could allow you to utilize the full tax credit. Third, gather all the necessary documentation. Keep records of the vehicle's purchase price, vehicle identification number (VIN), and any other information that might be required when you file your taxes. Finally, don't hesitate to seek professional advice. A qualified tax advisor can help you navigate the complexities of the tax credit system and ensure that you're taking full advantage of all available benefits. They can also provide personalized guidance based on your individual financial situation. By following these recommendations, you can increase your chances of successfully claiming the federal tax credit for your hybrid vehicle. Remember that knowledge is power. The more you know, the better prepared you'll be to make informed decisions and optimize your tax savings. Don't be afraid to ask questions and seek expert advice.

Digging Deeper: Understanding Battery Capacity Requirements

Let's delve a bit deeper into the specifics of battery capacity requirements. As mentioned earlier, to qualify for a federal tax credit, a hybrid vehicle must typically have a battery capacity of at least 7 kilowatt-hours (k Wh). This threshold is significant because it's generally associated with vehicles that offer a meaningful amount of electric driving range. The larger the battery capacity, the greater the potential tax credit amount, up to the maximum of $7,500. However, it's not simply a linear relationship. The IRS uses a formula to calculate the credit amount based on the battery's k Wh capacity, with incremental increases in credit for each additional k Wh. For example, a vehicle with a 7 k Wh battery might qualify for a base credit amount, while a vehicle with a 10 k Wh battery would qualify for a larger credit. It's also important to understand the difference between total battery capacity and usable battery capacity. The total battery capacity refers to the overall energy storage capability of the battery pack, while the usable battery capacity is the portion that the vehicle's system allows you to access. Automakers often limit the usable capacity to prolong the battery's lifespan and prevent it from being fully discharged. When determining the tax credit eligibility, the IRS typically considers the total battery capacity. Finally, keep in mind that battery technology is constantly evolving. Automakers are continually developing batteries with higher energy densities and longer lifespans. As battery technology improves, the requirements for tax credit eligibility may also change. Staying informed about these technological advancements and their implications for tax credits is crucial for making informed purchase decisions. The best way to understand this concept is that the bigger the battery, the bigger your potential tax credit. But that's not the only criteria.

Essential Tips for Claiming Your Hybrid Tax Credit

Claiming your hybrid tax credit requires careful attention to detail and proper documentation. Here are some essential tips to guide you through the process. First, accurately identify the eligible vehicle. Verify that the vehicle you purchased is listed on the IRS website as a qualifying vehicle for the year you acquired it. Note the vehicle identification number (VIN) and keep a copy of the vehicle's window sticker or sales contract, which typically includes this information. Second, determine your eligibility based on income. Review the MAGI limits for the tax year in question and ensure that your income falls within the allowed range. If your income is close to the limit, consult with a tax advisor to explore potential strategies for reducing your MAGI, such as contributing to a tax-deferred retirement account. Third, complete IRS Form 8936. This is the form you'll use to claim the Clean Vehicle Credit (formerly known as the Electric Vehicle Tax Credit) when you file your federal income tax return. The form requires information about the vehicle, including its VIN, the date you placed it in service (i.e., the date you took possession of it), and the amount of the credit you're claiming. Fourth, keep meticulous records. Retain all documentation related to the vehicle purchase, including the sales contract, window sticker, and any other paperwork that supports your claim. This will be helpful if the IRS ever audits your tax return. Finally, file your taxes electronically. Filing electronically is generally faster and more accurate than filing a paper return, and it reduces the risk of errors that could delay your refund. By following these tips, you can ensure a smooth and successful process for claiming your hybrid tax credit. Remember, preparation is key. Take the time to gather the necessary information and understand the requirements before you file your taxes.

Potential Pitfalls to Avoid When Claiming the Credit

While the process of claiming a hybrid tax credit may seem straightforward, there are several potential pitfalls to avoid. One common mistake is relying on outdated information. Tax laws and IRS guidelines can change frequently, so it's crucial to consult the most recent sources. Don't assume that what you read in a year-old article is still accurate. Another pitfall is failing to verify the vehicle's eligibility. Just because a vehicle is advertised as a hybrid doesn't automatically mean it qualifies for the tax credit. Always check the IRS website to confirm that the specific make and model is listed as an eligible vehicle. A third mistake is miscalculating the credit amount. The credit is based on the vehicle's battery capacity and may be subject to limitations based on your income and tax liability. Carefully review the IRS instructions for Form 8936 and use the provided worksheets to calculate the correct credit amount. A fourth pitfall is neglecting to keep adequate records. You'll need to retain documentation to support your claim, including the vehicle's sales contract, window sticker, and any other relevant paperwork. If you're audited, you'll be required to provide these documents to the IRS. A final mistake is failing to seek professional advice. If you're unsure about any aspect of the tax credit process, consult with a qualified tax advisor. They can help you navigate the complexities of the tax laws and ensure that you're taking full advantage of all available benefits. By being aware of these potential pitfalls and taking steps to avoid them, you can increase your chances of successfully claiming your hybrid tax credit and avoid any issues with the IRS. Remember, it's better to be safe than sorry. When in doubt, seek professional guidance.

Fun Facts About Hybrid Cars and Tax Credits

Did you know that the first mass-produced hybrid car, the Toyota Prius, was introduced in Japan in 1997 and in the United States in 2000? This marked the beginning of a new era in automotive technology, and it paved the way for the development of many other hybrid models. Early hybrid tax credits were designed to encourage the adoption of these relatively new and expensive vehicles. These credits helped to make hybrids more affordable for consumers and stimulated demand for fuel-efficient vehicles. Another fun fact is that the amount of the hybrid tax credit has varied over time, depending on factors such as the vehicle's fuel efficiency and the number of vehicles sold by the manufacturer. As manufacturers reached certain sales thresholds, the credit began to phase out, reflecting the increasing maturity of the hybrid market. The Inflation Reduction Act has brought about significant changes to the EV and hybrid tax credit landscape, with a renewed focus on domestic manufacturing and battery sourcing. This has created both challenges and opportunities for automakers and consumers alike. It's also interesting to note that some states offer additional tax incentives or rebates for hybrid vehicles, further reducing the cost of ownership. These state-level incentives can be combined with the federal tax credit to provide even greater savings. Finally, keep in mind that the definition of a "hybrid" car can vary. Some vehicles are classified as mild hybrids, which offer limited electric driving range, while others are plug-in hybrids, which can be charged from an external source of electricity and offer a more substantial electric range. The eligibility for tax credits may differ depending on the type of hybrid vehicle. Stay updated on the newest and latest models! You might be surprised with their offer.

How to Actually Claim the Hybrid Tax Credit in 2025?

Let's break down the steps involved in claiming the hybrid tax credit in 2025. The first crucial step is to confirm your eligibility. Verify that the specific hybrid vehicle you purchased meets all the requirements outlined by the IRS, including battery capacity, manufacturing location, and any other relevant criteria. You can find this information on the IRS website or by consulting with a tax professional. Next, determine your Modified Adjusted Gross Income (MAGI). This is a key factor in determining your eligibility for the credit, as the Inflation Reduction Act has established income limitations. Calculate your MAGI using the IRS guidelines and ensure that it falls within the allowed range. Once you've confirmed your eligibility and determined your MAGI, gather all the necessary documentation. This includes the vehicle's sales contract, window sticker, and any other paperwork that supports your claim. You'll also need to have your Social Security number and other personal information readily available. The next step is to complete IRS Form 8936, Clean Vehicle Credits. This form is used to claim the Clean Vehicle Credit (formerly known as the Electric Vehicle Tax Credit) when you file your federal income tax return. Fill out the form accurately and completely, providing all the required information. Finally, file your tax return electronically. Filing electronically is generally faster and more accurate than filing a paper return, and it reduces the risk of errors that could delay your refund. Be sure to file your tax return on time to avoid any penalties. By following these steps carefully, you can ensure a smooth and successful process for claiming your hybrid tax credit. Remember, accuracy and attention to detail are essential.

What If Hybrid Cars Don't Qualify for the Tax Credit in 2025?

Let's explore the potential implications if hybrid carsdon'tqualify for the federal tax credit in 2025. If this were to happen, it could have several significant effects on the automotive market and consumer behavior. First, it could reduce the demand for hybrid vehicles. Without the financial incentive of the tax credit, some potential buyers might be less inclined to purchase a hybrid, particularly if they're considering other fuel-efficient options. Second, it could impact the sales of automakers that rely heavily on hybrid vehicle sales. Automakers might need to adjust their pricing strategies or offer other incentives to maintain their sales volume. Third, it could slow down the transition to electric vehicles. Hybrid cars often serve as a stepping stone for consumers who are not yet ready to fully commit to an all-electric vehicle. Without the tax credit, some consumers might delay their adoption of electric vehicles. Fourth, it could affect the environment. Reduced demand for hybrid vehicles could lead to higher overall fuel consumption and greenhouse gas emissions. However, it's also possible that the absence of the tax credit could spur innovation in the hybrid vehicle market. Automakers might be motivated to develop more efficient and affordable hybrid technologies to remain competitive. In addition, the government could explore other policies to promote the adoption of clean vehicles, such as fuel efficiency standards or infrastructure investments. Ultimately, the impact of eliminating the hybrid tax credit would depend on a variety of factors, including consumer preferences, technological advancements, and government policies. While the tax credit provides a valuable incentive, it's not the only factor driving the adoption of hybrid vehicles. Keep in mind that market conditions may change regardless of tax laws.

Top Things to Remember About Hybrid Tax Credits in 2025: A Listicle

Let's distill everything we've discussed into a concise list of key takeaways regarding hybrid tax credits in 2025:

- Eligibility hinges on meeting IRS requirements: Not all hybrids qualify, so verify your vehicle's eligibility on the IRS website.

- The Inflation Reduction Act has changed the game: Pay close attention to battery sourcing and manufacturing requirements.

- Income limits apply: Your Modified Adjusted Gross Income (MAGI) must be within the allowed range to claim the credit.

- Battery capacity matters: The larger the battery, the greater the potential tax credit amount.

- Timing is crucial: Claim the credit in the year you take possession of the vehicle.

- Keep thorough records: Retain all documentation related to the vehicle purchase.

- Complete IRS Form 8936: Use this form to claim the Clean Vehicle Credit on your tax return.

- Seek professional advice: Consult with a tax advisor if you have any questions or concerns.

- Stay informed about changes: Tax laws and IRS guidelines can change frequently.

- Don't rely on outdated information: Always consult the most recent sources.

By keeping these key points in mind, you'll be well-equipped to navigate the complexities of hybrid tax credits and make informed decisions about your vehicle purchase.

Question and Answer: Do Hybrid Cars Qualify for a Federal Tax Credit in 2025?

Here are some frequently asked questions about hybrid car tax credits in 2025:

Q: Will all hybrid cars qualify for the federal tax credit in 2025?

A: No, not all hybrid cars will qualify. Eligibility depends on meeting specific requirements outlined by the IRS, including battery capacity, manufacturing location, and income limits.

Q: What is the maximum amount of the federal tax credit for hybrid cars in 2025?

A: The maximum credit amount is $7,500, but the actual amount may vary depending on the vehicle's battery capacity and compliance with domestic sourcing requirements.

Q: What is the Modified Adjusted Gross Income (MAGI) limit for claiming the hybrid tax credit in 2025?

A: The MAGI limits vary depending on your filing status. Consult the IRS website for the most up-to-date information on these limits.

Q: Where can I find a list of hybrid cars that qualify for the federal tax credit in 2025?

A: The IRS website provides a list of qualifying vehicles. Be sure to check this list before purchasing a hybrid car to ensure that it's eligible for the tax credit.

Conclusion of Do Hybrid Cars Qualify for a Federal Tax Credit in 2025?

Navigating the world of hybrid car tax credits in 2025 requires careful research and attention to detail. The Inflation Reduction Act has introduced significant changes to the eligibility requirements, making it essential to stay informed and consult reliable sources such as the IRS website and qualified tax professionals. While the tax credit can provide a valuable incentive for purchasing a hybrid vehicle, it's crucial to understand the specific criteria and potential pitfalls to ensure a smooth and successful claiming process. By following the tips and recommendations outlined in this guide, you can make informed decisions and maximize your potential tax savings.